Transaction costs are fees for sending money to vendors. Fees are charged by banks and payment systems.

By default, those fees are subtracted from the payment amount sent to the contractor. However, if a customer wants their contractor to receive payment in full without having to bear the cost of extra commissions, customer can compensate for the transaction costs.

How to compensate transaction costs for vendors

If transaction costs are to be fully compensated by the customer and not to be subtracted from the payment to the contractor, customer should inform us at Support@smartcat.com. Please, keep in mind that compensation is available for all workspace members with one exception — vendors found through Smartcat Marketplace.

How compensation works

On the last business day of the month, we calculate total transaction costs for all payments that were sent to your contractors during the reporting month. This amount is invoiced to you.

We will email you a breakdown of transaction costs within 5 business days. This breakdown includes the amount of the commissions, as well as detailed description of each accrual with matching payment within the accounting period.

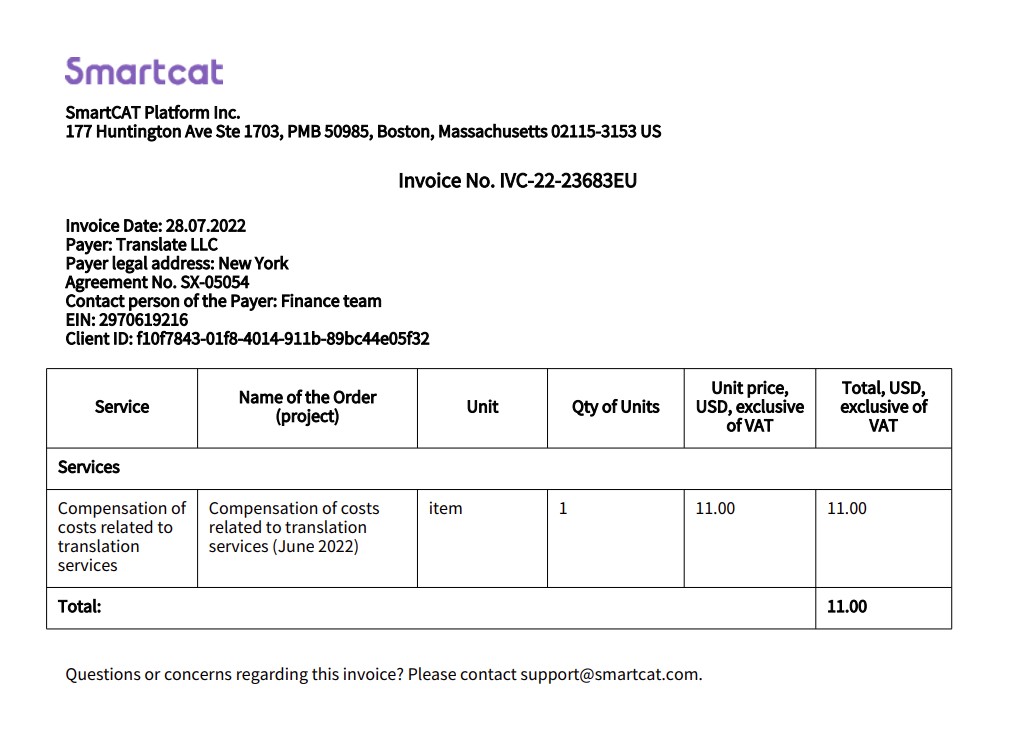

Here is an example of what the invoice would look like.

How we calculate transaction costs and how big they are

Transaction costs depend on the payment method chosen by the contractor. That is the exact fee amount is available only after choosing payment method and receiving the payment.

Fee amounts for each payment method are displayed below:

Did this article help you find the answer you were looking for? If not or if you have further questions, please contact our support team.