Smartcat works with a subcontracting scheme which means our Clients work with Smartcat under a Customer Agreement (https://www.smartcat.com/customer-agreement/), and in turn, Smartcat engages translators (individuals, legal entities) under a Supplier Agreement (https://www.smartcat.com/supplier-agreement/).

This means it is Smartcat’s obligation (not the Client’s) to issue freelancers with a 1099 form when they receive payments totaling $600 or more from Smartcat in a given calendar year.

To identify the tax status of translators, we collect the following forms:

- Form W-9: for U.S. citizens (even if they reside outside the United States) or residents of the United States

- Form W8-BEN: for individuals (not legal entities) who are non-residents of the United States

- Form W8-BEN-E: for non-U.S. legal entities

Сollecting these forms from translators as well as filing the 1099 form with the IRS can consume a lot of your business’ resources. By working through Smartcat, you save time and effort when it comes to your annual 1099 reporting campaigns.

How Smartcat pays suppliers:

- Suppliers who specify the United States as their country on their Smartcat profiles receive payments from our US legal entity.

- Suppliers from other countries may receive payments from both our US and EU legal entities.

This means that there is no need for you to request W forms or prepare 1099 forms if you work with your suppliers via Smartcat.

Process overview

1. Every month Smartcat notifies the suppliers who need to provide IRS forms.

Note that we will only take into account payments that are paid out to freelancers via their payment method. In other words, if a supplier received payments for their services in their Smartcat balance but funds have not been withdrawn by or paid out to the beneficiary (e.g. if a supplier has not provided a payout method, their balance has not reached the minimum payout amount or any other reasons), this amount will not be included in our calculations.

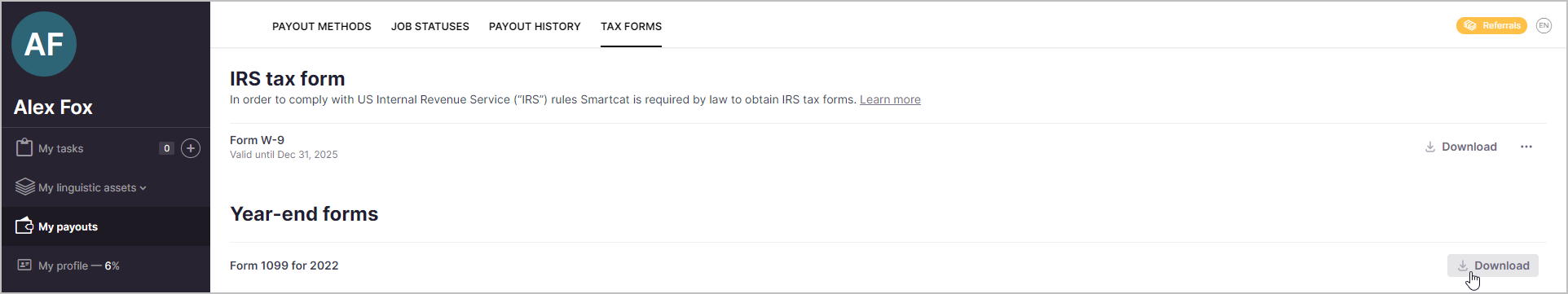

2. Freelancers have to upload their W forms to their personal accounts in the Smartcat Platform. All data is transferred via an encrypted connection and is encrypted to ensure that it is stored safely.

3. All freelancers who are U.S. residents or citizens and provide Smartcat with a W-9 form will get a 1099 form from Smartcat confirming their income. It can take one month or more, after the given calendar year, for the form to be processed and available in a supplier’s account.

Smartcat will notify suppliers once their 1099 form is ready.

No additional action is required from you in this process. Please make sure you don’t submit 1099 forms on our behalf.

All translators who are non-U.S. residents or citizens have to upload their W8 forms (W8-BEN or W-8BEN-E) as evidence that they should not be subject to any deductions from their income received via Smartcat. No further action is required from them either.

For more information about the process, refer to this article.

If you have any questions or concerns, please contact us.