Before remitting your first payment via Smartcat, you need to provide the billing details of the company on whose behalf you will work on the platform. Company billing details include:

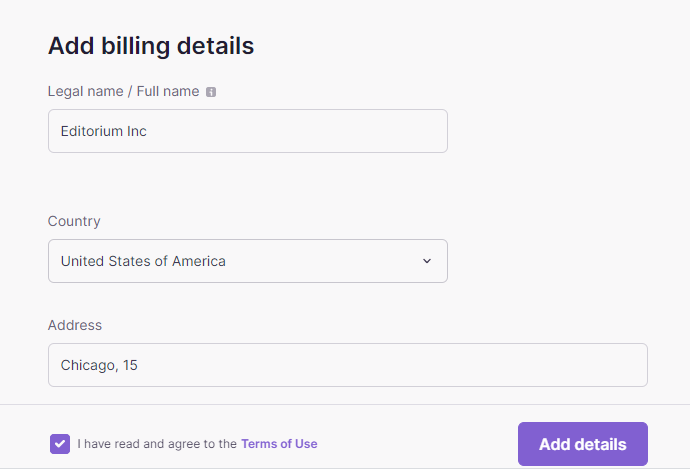

- Legal name

- Country

- Address

- Phone number

- Contact person

- Tax ID/VAT number

- Billing currency

- Billing email address for invoicing

Use the steps below to enter your details:

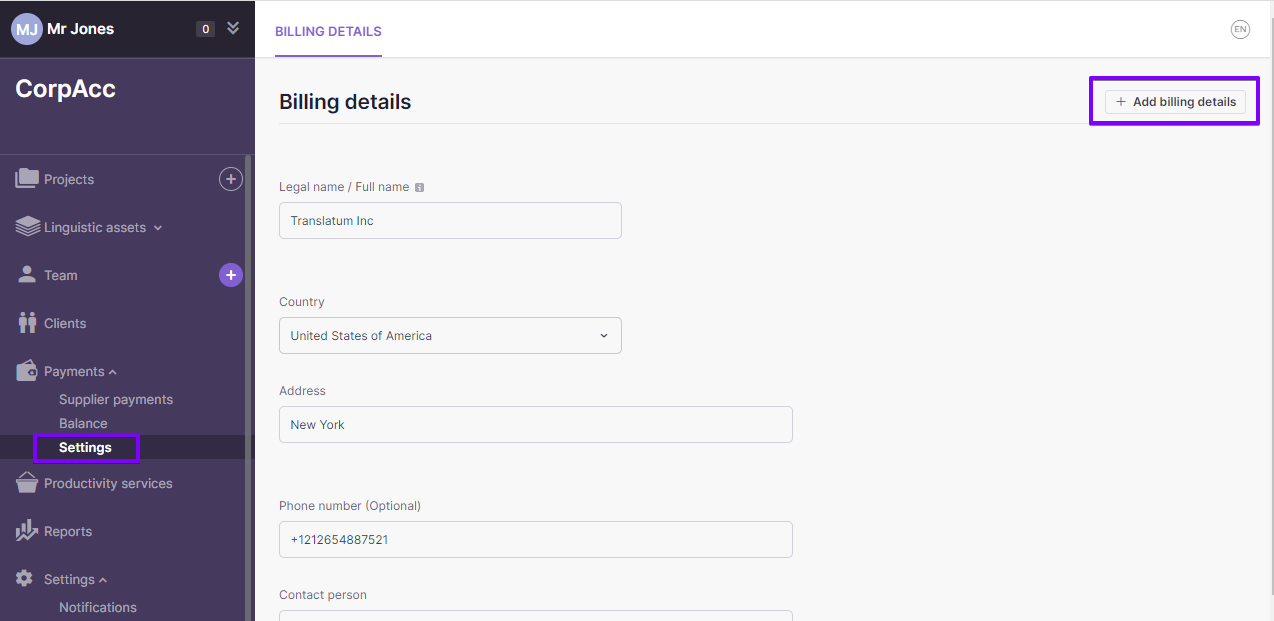

- Navigate to Payments > Settings > Billing details and click Add billing details.

- Populate the required fields and click Add details.

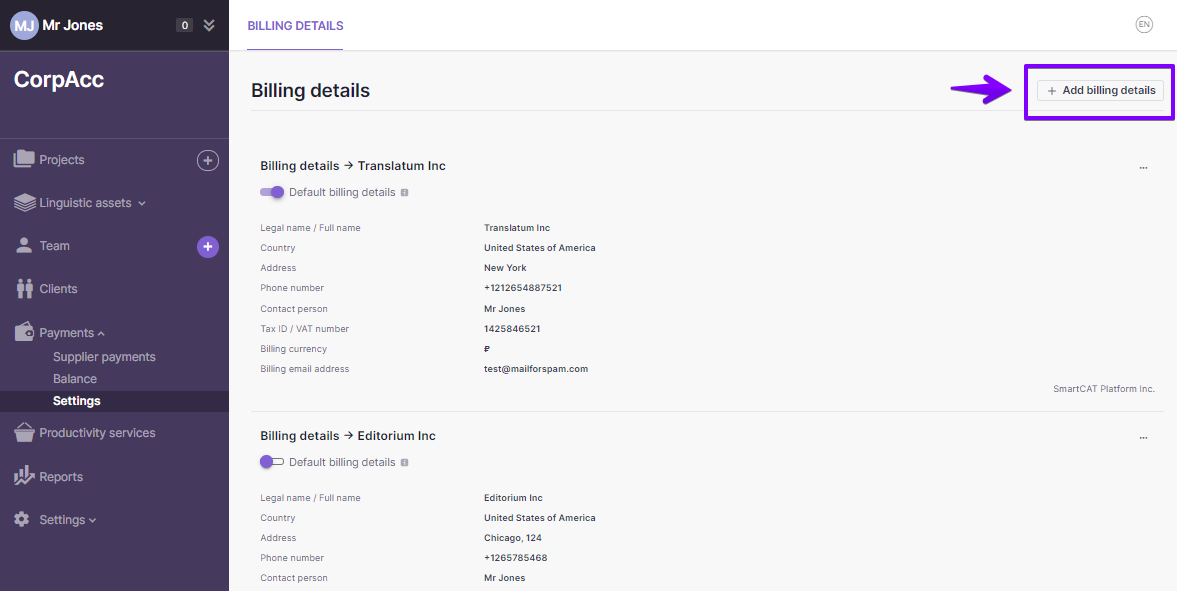

Now you can use the specified details to receive invoices made out to this legal entity via Smartcat or to pay your suppliers from the balance of this legal entity.

- If you use your corporate Smartсat account as an umbrella account for several legal entities, you can add additional billing details. To do this, click Add billing details.

To switch to working with the new details, set them as your default billing details. The default details determine:

- A legal entity referred to as the Payer in invoices and other related documents

- Billing currency

- The balance from which your suppliers are paid

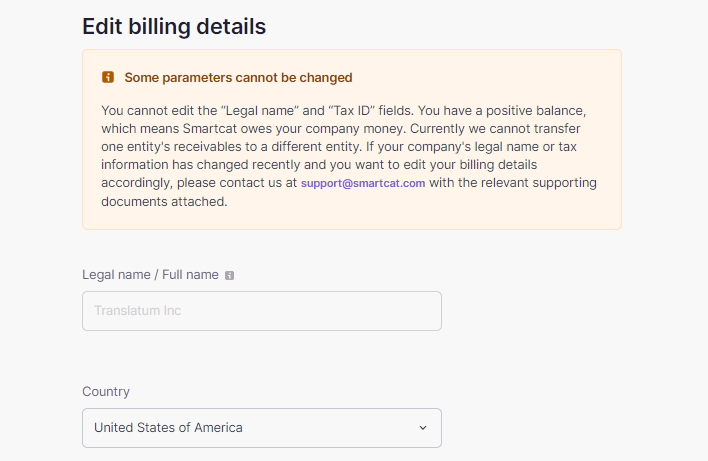

- Deletion of current billing details may be restricted by the availability of funds on the balance of the legal entity.

It is necessary that the balance of this legal entity be equal to zero. To achieve this, select completed jobs and pay for them from the balance of the current legal entity or request a withdrawal of funds from the balance.

Once the balance is equal to zero, you can remove your billing details. If these details were selected as the default details, then other details from the remaining ones will be automatically assigned as the default. You can change the default details at any time.

Did this article help you find the answer you were looking for? If not or if you have further questions, please contact our support team.